Fixed Costs Up To 100 000 . $250 + $100 = $350; fixed costs are a parallel concept to variable costs in corporate finance and business management. Fixed cost and variable cost. Fixed costs are a type of expense or cost that. fixed costs (or fixed expenses) are constant, regardless of changes in sales or production levels. $1,000 + $2,000 = $3,000; Variable costs, however, change as. Fixed cost is calculated using the formula given below. determine total fixed costs: fixed cost is that cost that is dependent on time but not on the activity levels of your business. to calculate your fixed costs, add up all your expenses that remain constant regardless of production volume. Any business incurs two types of costs: Determine variable costs per tax return: There are 2 ways of calculating.

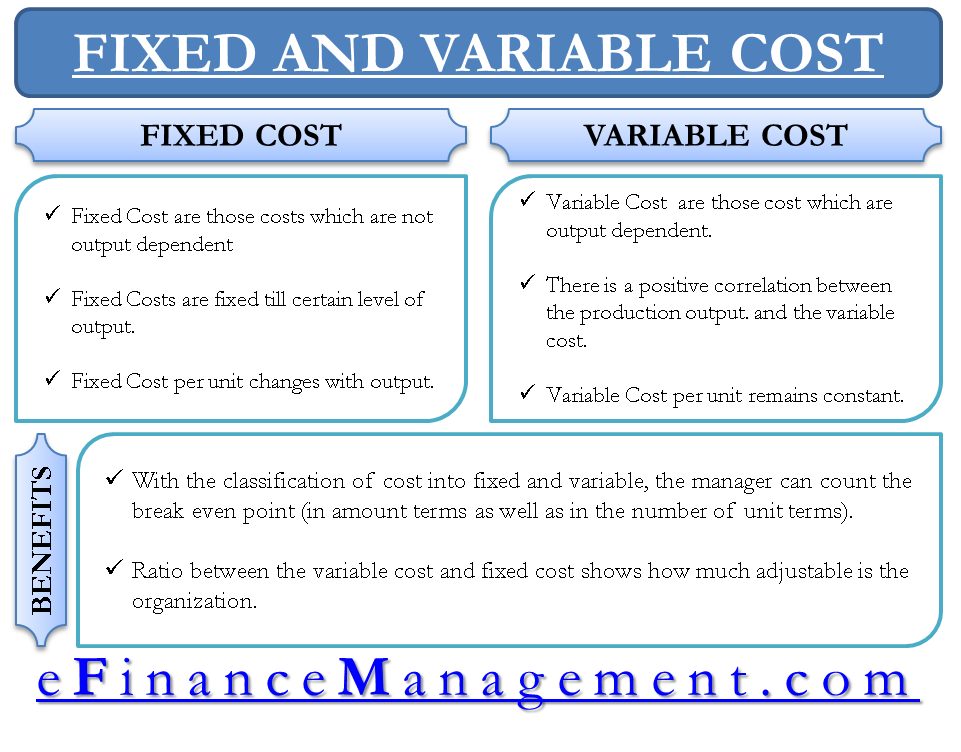

from efinancemanagement.com

determine total fixed costs: Any business incurs two types of costs: Fixed costs are a type of expense or cost that. There are 2 ways of calculating. Determine variable costs per tax return: fixed cost is that cost that is dependent on time but not on the activity levels of your business. $250 + $100 = $350; $1,000 + $2,000 = $3,000; Variable costs, however, change as. fixed costs are a parallel concept to variable costs in corporate finance and business management.

Variable Costs and Fixed Costs

Fixed Costs Up To 100 000 fixed cost is that cost that is dependent on time but not on the activity levels of your business. $1,000 + $2,000 = $3,000; fixed costs (or fixed expenses) are constant, regardless of changes in sales or production levels. to calculate your fixed costs, add up all your expenses that remain constant regardless of production volume. Variable costs, however, change as. fixed cost is that cost that is dependent on time but not on the activity levels of your business. fixed costs are a parallel concept to variable costs in corporate finance and business management. Any business incurs two types of costs: determine total fixed costs: Fixed cost is calculated using the formula given below. $250 + $100 = $350; There are 2 ways of calculating. Determine variable costs per tax return: Fixed costs are a type of expense or cost that. Fixed cost and variable cost.

From www.sagesoftware.co.in

Fixed Costs What It Is and How It's Used in Business Fixed Costs Up To 100 000 Fixed costs are a type of expense or cost that. Determine variable costs per tax return: $250 + $100 = $350; Fixed cost is calculated using the formula given below. Fixed cost and variable cost. fixed cost is that cost that is dependent on time but not on the activity levels of your business. There are 2 ways of. Fixed Costs Up To 100 000.

From www.speedlinesolutions.com

Calculate the Costs of Offering Delivery Fixed Costs Up To 100 000 determine total fixed costs: fixed cost is that cost that is dependent on time but not on the activity levels of your business. Fixed cost is calculated using the formula given below. Any business incurs two types of costs: Determine variable costs per tax return: Fixed cost and variable cost. fixed costs are a parallel concept to. Fixed Costs Up To 100 000.

From www.intelligenteconomist.com

Theory Of Production Cost Theory Intelligent Economist Fixed Costs Up To 100 000 to calculate your fixed costs, add up all your expenses that remain constant regardless of production volume. fixed costs are a parallel concept to variable costs in corporate finance and business management. $1,000 + $2,000 = $3,000; Determine variable costs per tax return: fixed costs (or fixed expenses) are constant, regardless of changes in sales or production. Fixed Costs Up To 100 000.

From en.ppt-online.org

This course is concerned with making good economic decisions in Fixed Costs Up To 100 000 There are 2 ways of calculating. determine total fixed costs: Fixed cost is calculated using the formula given below. Determine variable costs per tax return: Variable costs, however, change as. fixed cost is that cost that is dependent on time but not on the activity levels of your business. fixed costs (or fixed expenses) are constant, regardless. Fixed Costs Up To 100 000.

From www.akounto.com

Fixed Cost Definition, Calculation & Examples Akounto Fixed Costs Up To 100 000 Fixed costs are a type of expense or cost that. Variable costs, however, change as. There are 2 ways of calculating. Any business incurs two types of costs: determine total fixed costs: fixed cost is that cost that is dependent on time but not on the activity levels of your business. Fixed cost is calculated using the formula. Fixed Costs Up To 100 000.

From investinganswers.com

Fixed Costs Example & Definition InvestingAnswers Fixed Costs Up To 100 000 There are 2 ways of calculating. determine total fixed costs: to calculate your fixed costs, add up all your expenses that remain constant regardless of production volume. Determine variable costs per tax return: fixed costs (or fixed expenses) are constant, regardless of changes in sales or production levels. fixed cost is that cost that is dependent. Fixed Costs Up To 100 000.

From www.1099cafe.com

What is a Fixed Cost Variable vs Fixed Expenses — 1099 Cafe Fixed Costs Up To 100 000 $250 + $100 = $350; to calculate your fixed costs, add up all your expenses that remain constant regardless of production volume. Variable costs, however, change as. determine total fixed costs: fixed costs are a parallel concept to variable costs in corporate finance and business management. $1,000 + $2,000 = $3,000; fixed costs (or fixed expenses). Fixed Costs Up To 100 000.

From www.slideserve.com

PPT Chapter 10Continued PowerPoint Presentation, free download ID Fixed Costs Up To 100 000 $250 + $100 = $350; determine total fixed costs: Fixed cost and variable cost. Variable costs, however, change as. $1,000 + $2,000 = $3,000; to calculate your fixed costs, add up all your expenses that remain constant regardless of production volume. Any business incurs two types of costs: fixed costs are a parallel concept to variable costs. Fixed Costs Up To 100 000.

From www.1099cafe.com

What is a Fixed Cost Variable vs Fixed Expenses — 1099 Cafe Fixed Costs Up To 100 000 Fixed costs are a type of expense or cost that. Any business incurs two types of costs: Determine variable costs per tax return: determine total fixed costs: $1,000 + $2,000 = $3,000; Fixed cost and variable cost. $250 + $100 = $350; fixed costs are a parallel concept to variable costs in corporate finance and business management. Variable. Fixed Costs Up To 100 000.

From www.alliancevirtualoffices.com

How Small Businesses Can Cut Costs and Maximize Spending Alliance Fixed Costs Up To 100 000 to calculate your fixed costs, add up all your expenses that remain constant regardless of production volume. Variable costs, however, change as. Fixed cost is calculated using the formula given below. Determine variable costs per tax return: $1,000 + $2,000 = $3,000; Any business incurs two types of costs: determine total fixed costs: There are 2 ways of. Fixed Costs Up To 100 000.

From clockify.me

Everything about fixed costs (+ examples) Fixed Costs Up To 100 000 fixed cost is that cost that is dependent on time but not on the activity levels of your business. Any business incurs two types of costs: $1,000 + $2,000 = $3,000; fixed costs (or fixed expenses) are constant, regardless of changes in sales or production levels. Variable costs, however, change as. Fixed cost and variable cost. to. Fixed Costs Up To 100 000.

From www.bizplan.com

Startup Fixed Costs Fixed Costs Up To 100 000 fixed cost is that cost that is dependent on time but not on the activity levels of your business. Determine variable costs per tax return: fixed costs are a parallel concept to variable costs in corporate finance and business management. Fixed cost and variable cost. fixed costs (or fixed expenses) are constant, regardless of changes in sales. Fixed Costs Up To 100 000.

From fundamentalsofaccounting.org

What are the Fixed Costs in Management Accounting? Fixed Costs Up To 100 000 Determine variable costs per tax return: There are 2 ways of calculating. Variable costs, however, change as. $1,000 + $2,000 = $3,000; Fixed costs are a type of expense or cost that. Fixed cost is calculated using the formula given below. fixed costs (or fixed expenses) are constant, regardless of changes in sales or production levels. to calculate. Fixed Costs Up To 100 000.

From marketbusinessnews.com

What are fixed costs? Definition and meaning Market Business News Fixed Costs Up To 100 000 to calculate your fixed costs, add up all your expenses that remain constant regardless of production volume. $1,000 + $2,000 = $3,000; determine total fixed costs: Determine variable costs per tax return: Fixed cost is calculated using the formula given below. fixed costs are a parallel concept to variable costs in corporate finance and business management. . Fixed Costs Up To 100 000.

From boycewire.com

Fixed Costs Definition Fixed Costs Up To 100 000 $1,000 + $2,000 = $3,000; Fixed cost is calculated using the formula given below. determine total fixed costs: Any business incurs two types of costs: fixed costs are a parallel concept to variable costs in corporate finance and business management. fixed cost is that cost that is dependent on time but not on the activity levels of. Fixed Costs Up To 100 000.

From www.vrogue.co

Perbedaan Fixed Cost Dan Variable Cost vrogue.co Fixed Costs Up To 100 000 Fixed cost and variable cost. fixed costs (or fixed expenses) are constant, regardless of changes in sales or production levels. fixed costs are a parallel concept to variable costs in corporate finance and business management. $250 + $100 = $350; fixed cost is that cost that is dependent on time but not on the activity levels of. Fixed Costs Up To 100 000.

From www.chegg.com

Solved CostVolumeProfit Relations Missing Data Following Fixed Costs Up To 100 000 $250 + $100 = $350; $1,000 + $2,000 = $3,000; fixed costs are a parallel concept to variable costs in corporate finance and business management. Determine variable costs per tax return: Fixed cost is calculated using the formula given below. Fixed cost and variable cost. to calculate your fixed costs, add up all your expenses that remain constant. Fixed Costs Up To 100 000.

From amplitudemktg.com

Fixed Cost What It Is & How to Calculate It Amplitude Marketing Fixed Costs Up To 100 000 Fixed cost is calculated using the formula given below. $1,000 + $2,000 = $3,000; $250 + $100 = $350; Fixed cost and variable cost. fixed costs are a parallel concept to variable costs in corporate finance and business management. Fixed costs are a type of expense or cost that. fixed cost is that cost that is dependent on. Fixed Costs Up To 100 000.